Guest Writer: Strategies to Make Your Charitable Giving Go Further

By Danielle Harrison, CFP®

2020 was a challenging year to say the least. Between the division in our country and the upending of our lives due to the pandemic, many were faced with situations they never imagined having to deal with. We witnessed lost jobs, lost lives, and lost moments. Despite the angst that was felt, there were some rays of hope that cut through the dark cloud that was 2020. Notwithstanding the economic hardships seen this past year, the level of

charitable giving did not plummet as would have been expected. Although accurate numbers for 2020 have not yet been confirmed, according to the Fundraising Effectiveness Project’s 2020 Third Quarter Report, giving was up 7.6% in the first three quarters of 2020 versus the same period in 2019 and Giving Tuesday saw a 25% increase. As the board president of a local non-profit that manufactures and distributes hand-cranked carts to the handicapped in developing countries, our early board meetings in 2020 were centered around planning for the worst. We were pleasantly surprised as the level of giving did not fall substantially, but rather surpassed every other year in our 26-year history.

For those charitably inclined individuals who gave this past year or who are looking to make donations in the future, there are many strategies available to make your charitable dollars go further.

Above the Line Tax Deductions

The CARES Act allowed for an above-the-line $300 tax deduction of cash donations made to charities in 2020. This $300 tax deduction is per tax return and applies to both single and married filers. For an individual or couple in the 24% tax bracket taking full advantage of this deduction, their tax liability would be lowered by $72.

In late December, the Coronavirus Relief Bill was passed extending the $300 above-the-line tax deduction into 2021. This time, however, joint filers can deduct up to $600 of cash donations made to qualifying charities.

For both 2020 and 2021 donations made to donor-advised funds or private charities do not qualify. The above-the-line deduction is also only available to tax filers who do not itemize their deductions.

Temporary Suspension of Limitations on Deductible Charitable Contributions

For those individuals who do itemize their deductions, cash donations to charities are typically limited to 60% of the filer’s Adjusted Gross Income (AGI). In 2020 and 2021, however, these AGI limitations have been increased to 100% of AGI for qualifying organizations. Any cash donations above this amount can be carried forward for five years.

Qualified Charitable Distributions

Individuals age 70 ½ and older may make charitable contributions directly from their Individual Retirement Account (IRA) to qualified charities, of up to $100,000 per year. The amount of these charitable contributions is excluded from their taxable income.

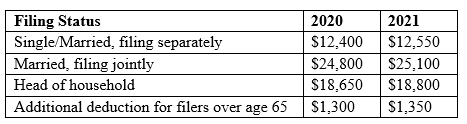

Qualified Charitable Distributions (QCDs) from IRAs have become much more prevalent due to the Tax Cut and Jobs Act (TCJA) signed into law in 2017. The TCJA nearly doubled the standard tax deduction which decreased the number of filers who benefited from itemizing. Prior to the Act, approximately 30% of individuals itemized their deductions, including their charitable contributions. Now the number of filers who itemize is closer to 10%.

Standard Tax Deduction

Since a QCD is not considered taxable income, it also cannot be used as an itemized deduction. A filer must choose whether to make a QCD or itemize the charitable contribution. Even if a filer does itemize, QCDs can still be a useful strategy. For one, QCDs lower a filers AGI which can affect things such as the Medicare surcharge, taxation of Social Security, or eligibility for various programs. It can also be useful for those who have surpassed the AGI limitations (typically 60% for cash donations, though as stated above, 100% for 2020 and 2021).

Prior to December 2019 when the SECURE Act was signed, QCDs and required minimum distributions (RMDs) went hand-in-hand. At that time, once an individual reached the age of 70 ½ they were required to take a minimum distribution from their account on an annual basis. The minimum amount is based on the account balance on December 31st of the previous year and one’s life expectancy factor. QCDs could also be made starting at age 70 ½ and were frequently used in tandem since the charitable deductions could be applied toward an IRA owner’s RMD. Following the SECURE Act, the new required minimum distribution age has been increased to 72, but the QCD age remains 70 ½.

The SECURE Act also made it feasible for individuals to contribute to their IRA after age 70 ½, which was not previously the case. To do this, the individual must have earned income in the year of the contribution. It gets a bit more complicated if someone contributes to an IRA past age 70 ½ and wants to make qualified charitable contributions directly from the IRA. Contributions to an IRA after the age of 70 ½ will reduce any future QCDs made, even if they aren’t made in the same year. For example, an individual contributes $5,000 from her consulting work into her IRA at the age of 71. At the age of 75 she decides to make a direct gift from her IRA to her favorite charity in the amount of $12,000. The first $5,000 is not considered a QCD, but instead will be treated as ordinary income. The remaining $7,000 will be treated as a QCD and not included as taxable income at the time of the distribution.

Bunching Charitable Donations

Another technique that has become more popular since the Tax Cut and Jobs Act is the use of “bunching” or “bundling” charitable donations. This is accomplished by lumping multiple years of charitable donations into one tax year versus making smaller annual donations. With large enough donations, this can allow the donor to take advantage of itemizing their charitable contributions. For example, under the TCJA, a couple who normally takes the standard deduction but who gives to charity may decide that instead of making their $15,000 annual charitable donation they will make $30,000 in one year and not the next, making itemizing worthwhile.

If this strategy is used, particularly when giving to smaller organizations, I do recommend letting them know at the time of donation. Most non-profit organizations base their budgets off past year donations and may incorporate your larger than normal gift into their annual budget without proper notification, increasing the potential for a budget shortfall.

Gifting Appreciated Stock

An often-overlooked strategy is to gift appreciated stock directly to a charity. This approach has many benefits. An individual escapes paying capital gains on any appreciation of the stock and because the charity is not a taxable entity, the holding can be liquidated with no taxes due allowing for the organization to benefit by the full market value of the security at the time of sale. In addition, the donor gets to deduct the full market value at the time of the gift. This is an excellent opportunity for someone who has invested in a security that has performed well, wants to diversify their holdings, but doesn’t want the capital gains hit.

Because this is an appreciated asset, AGI limits are 30% versus the 60% for cash in a standard year (100% for 2020 and 2021). This strategy is also more advantageous for stock that has been held for over a year. If it has been held for less than a year, you still get the benefit of not having to pay ordinary income taxes on the appreciation, but the deduction is limited to the lesser of the fair market value and the amount you paid for it.

Gifting of stock should be limited to stocks that have increased in value. If you want to donate a stock that has lost value, you are better off selling the security, taking the loss (which can be used to offset other capital gains) and donating the cash to the charity.

Donor-Advised Funds

Bunching of charitable donations and gifting of appreciated stock can be paired with donating to a (DAF). Once a donation is made to a donor-advised fund, the sponsoring organization has legal control over it, but the donor retains the right to advise on the investment and distribution of funds. The donor can reap the tax benefits at the time of the contribution and because the funds held within the DAF belong to the sponsoring organization, any additional gains will not be taxed.

A donor-advised fund can be a solution to combat the “lumpy” giving characterized by bunching/bundling of charitable donations. Large lump sums can be donated to a DAF to take full advantage of itemizing and then the fund can make annual charitable donations on your behalf. Note that the increased AGI percentage limits for 2020 and 2021 do not apply to donor advised funds, but again, charitable donations above AGI limits can be carried forward for up to five years.

Although a donor-advised fund is a charity, it does not count as a qualified charitable deduction, so donations made from an IRA to a DAF will not be given any special tax treatment.

Charitable Trusts

Finally, for those wanting to take it one step further, a charitable trust can be created. A charitable lead trust and a charitable remainder trust are the most common irrevocable trusts used to achieve this goal. There are several tax advantages associated with these trusts such as limited income, capital gain, and estate taxes, but are much more complicated to establish. A qualified estate planning attorney should be involved to ensure proper creation.

About the author: Danielle Harrison, CFP®

Danielle R. Harrison, MBA, CFP®, CFT-I™ is the founder and president of Harrison Financial Planning, a fee-only financial planning firm based in Mid-Missouri and equipped to work with clients across the country. Harrison Financial Planning provides comprehensive financial planning and investment management and is there to help guide clients through any financial decisions that arise. Harrison Financial Planning specializes in working with busy professionals and retirees who enjoy giving back through their profession, volunteerism, or charitable giving.